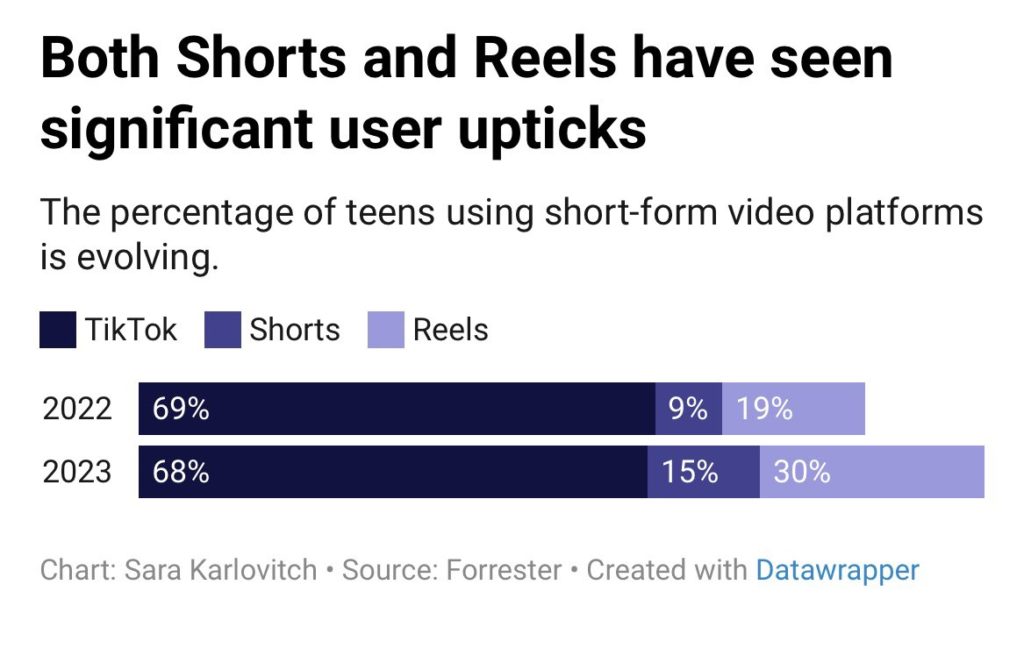

The landscape of teen engagement on TikTok, a social media giant, is undergoing subtle shifts, as indicated by Forrester’s 2023 Youth Survey. While TikTok’s weekly usage among Gen Z teens has experienced a marginal dip from 69% in 2022 to 68% in 2023, it still maintains a lead over competitors. Notably, nearly one-third of teens engage with Reels weekly, and Shorts is gaining traction.

Notably, the survey indicates a shifting tide in the popularity of various platforms among teens. Despite a marginal decline in weekly TikTok usage from 69% in 2022 to 68% in 2023, TikTok retains its stronghold as the most widely used “social media” platform among U.S. teens. This slight dip did not impede TikTok from achieving a significant milestone, surpassing the weekly usage of core YouTube for the first time. YouTube witnessed a 3-point year-over-year drop to 66%, positioning TikTok at the forefront of teen engagement.

Reflecting on historical trends, two years ago, our insights highlighted TikTok’s ascendancy, overtaking Instagram with 63% and 57% weekly usage, respectively, in 2021. The subsequent years witnessed a continuation of this trend, with TikTok maintaining higher weekly usage than its visual-centric counterpart, Instagram, which has experienced a resurgence nearing its pre-pandemic levels of 63%.

In the realm of short-form video content, TikTok remains unrivaled, despite the noteworthy advancements of competitors. Instagram Reels, experiencing an 11-point year-over-year surge, now captivates nearly a third (30%) of U.S. teens weekly. Concurrently, YouTube Shorts marks a 6-point increase to 15% in weekly usage. Nevertheless, both Reels and Shorts have substantial ground to cover to challenge TikTok’s dominance in the short-form video arena.

A critical distinction arises in the nature of TikTok’s competition. Unlike TikTok, conceived as a dedicated short-form video app, Instagram Reels and YouTube Shorts are integral features within their parent apps—Instagram and YouTube, respectively. The integration of Reels and Shorts into the overall user interface diminishes the distinctions between these features and their parent platforms. Consequently, TikTok finds itself not in a direct competition with Reels and Shorts but rather vying against the overarching platforms of Instagram and YouTube. This strategic insight sheds light on TikTok’s recent foray into experimenting with long-form video content.

Intriguingly, Meta, the parent company of Instagram, has Meta’s AI-based recommendation engine to thank for the momentum witnessed in Instagram’s Q3 earnings report. Mark Zuckerberg disclosed that Reels contributed to a remarkable “more than” 40% increase in time spent on Instagram. The incorporation of artificial intelligence has been pivotal in driving the discoverability and engagement of Reels, marking a paradigm shift in user behavior. Despite initial resistance to Instagram’s algorithmic feed, the data underscores its instrumental role in propelling the success of Reels.

Looking ahead, the trajectory suggests that the momentum gained by Reels is poised to extend into 2024, heralding a potential resurgence for “big media.” This comprehensive analysis not only underscores the evolving landscape of teen social media preferences but also provides strategic insights for marketers and industry stakeholders navigating this dynamic terrain.

Source: Forrester